After more sell off this week I expect the FOMC cutting rates and restarting QE on the 18th will cause a rally in markets and a steepening of the yield curve during Q2. But I think the rally will be more like a short squeeze; so index led, some areas of better credit coming in, USD bounce. Overall I think an FOMC inspired rally will last 3-6 months max.

Auto sector malaise

After that the lack of auto recovery will be an issue again. As an anecdote I was at the auto shop today and the guy there was saying ordinary people simply cant afford EV's and PHEV's and the middle class don't want to sell older ICE cars partly due to cost, partly they are waiting to be forced/ incentivised to upgrade, so you have people holding onto 5-10 year old cars longer than they would otherwise. Also EV/ PHEV cars are not reliable enough; broken motors and batteries cost thousands to replace. So overall I think the auto recession will drag on and only a massive cash for clunker deal after a recession will turn it.

LMC Automotive data, global sales down 10% YoY to January:

US car sales are off a small amount over the last few years:

US China Trade War & EM trade

Then the trade war is unresolved, period. The drop in the oil price will slow EM growth and in turn US exports. Phase 2 of the China deal, which covers the most critical parts from China's standpoint, is hard to see happening this side of the election.

The fall in goods and services exports in 2000 and 2008 recessions both cost about 1.5% of GDP.

Oil Market Share War

There has been a lot of capex in the oil sector that has seen US production grow so much that net imports have gone from 12.5MMbpd to now a small net export position. The prospect of growing US exports has now triggered a price war by OPEC+ to protect market share.

The logic for OPEC+ is their balance sheets are stronger than leveraged US and other private sector oil producers. So by crashing the oil price now, they will try and bankrupt some of the higher cost offshore and tar sands producers and some of the leveraged onshore producers.

But OPEC+ need to make it painful enough for a few whales to go bankrupt and teach Wall Street to not finance higher cost producers going forwards. Given many E&P's hedge upwards of 50% of the next 12-months production, I'm not sure this war will be over by Christmas.

But OPEC+ need to make it painful enough for a few whales to go bankrupt and teach Wall Street to not finance higher cost producers going forwards. Given many E&P's hedge upwards of 50% of the next 12-months production, I'm not sure this war will be over by Christmas.

From a US economic stand point, oil related capex and the supply chain behind it have been a large part of US capex this cycle, the 2015/16 slowdown saw 'mining' sector capex halve and put several US states into recession/ near recession while the manufacturing sector as a whole went into recession.

Quarter on quarter a slowdown in mining/ energy can detract up to 1.1% from GDP, and then more in the manufacturing supply chain and service sector second round effects in the most affected states.

In the last oil price war manufacturing went from growing 4% a year to shrinking 1.8% by Q1-2016, quite an abrupt rate of change.

In 2015/16 oil slowed Texas down from 6% plus growth to zero and Texas has been one of the stronger growing states in the last couple of years.

Texas at about $1.9Tn GDP in 2019 would as a stand alone economy be of similar size to Russia and is 8.8% of US GDP.

Inventory Liquidations

What better way to manage cash flow, when you get squeezed? While the auto sector seems to have reduced inventory over the last few years, sectors like wholesalers have only just started and business inventories as a whole have been high.

One sector that has seen a large fall in

inventories to sales is retail and we know how many bankruptcies there

have been there. Below is what has happened to retail jobs:

So this time around we have the oil sector, exports and autos also going into a recession/ L-shaped recovery and the potential impact of inventory liquidations.

Corona virus distruptions

I do think the Corona virus will blow over during April as temperatures heat up - outbreaks have been limited to cold areas and only really broke out in Hubei because of an initial cover up. Apparently the high death rates in Italy is due to a shortage of respirators for those patients who suffer pneumonia, combined with a lack of initial outbreak containment.

However for the next few weeks it does look like the breakouts in Europe and the northern US states will get worse and disrupt the March and April GDP numbers and in my view are likely to drive more market sell offs before the FOMC on the 18th.

Credit default cycle

The defaults in oil are going to hurt credit. Most investors in credit are index investors, so to avoid the 9% in high yield that is energy related plus all of the other cyclical sector exposures, they generally have to sell their HY allocation as a whole. This dynamic blew out spreads across all of credit in 2016.

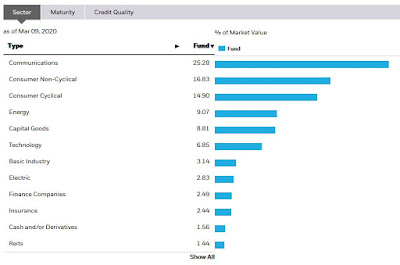

HYG ETF sectors:

HYG has a 6.00% OAS. The credit spread blow out so far has been very rapid, with 'B' OAS reaching 7.2% yesterday vs. about 7.7% in February 2016.

Conclusion

Adding all of this up, as many commentators have pointed out, the US private sector has been slowing towards a recession for months. The ISM Manufacturing survey was already showing falls in inventories, new orders, backlogs etc

So while I think the FOMC can juice markets for a few months, the underlying problems should hit in the run into the election campaign and the Democrats won't want a big fiscal stimulus to try and help Trump win re-election, in fact they would probably prefer a small market crisis. Democratic control of Congress can prevent any major stimulus happening before the election, although I am sure some health care spending will be agreed.

So that's it, my base case is more sell off over the next seven days, then FOMC stick save and a narrow short squeeze driven rally for a few months. The assets that don't participate in the rally go into a consolidation pattern for 3-6 months, similar to what happened in the chart below between March and August 2008.

After that, as the economy and corporate profits surprise on the downside again, then a renewed sell off/ recession/ liquidation event later this year will clear the way for fiscal deficits for as long as it takes to get higher wage inflation going.

No comments:

Post a Comment