The corporate savings rate rose in Q3 as per the Z1 survey and looks like it has probably risen more since.

It's a bit weird as capital formation ie capex, was rising into year end.

As per the chart below business loans picked up a little in Jan and are flat in the first week of Feb so far having gone negative for a few weeks in Q4.

Good job Yellen didnt hike rates to a neutral level before leaving the Fed as I think that would probably be enough to trigger a recession.

Instead we have continuing very loose rates trying to underwrite, in my view, a transition between economic cycles without a recession in the middle.

The new cycle will involve lower corporate margins and more defaults. So how do you play credit spreads widening over time?

One simple solution is CLO equity. If during the two year reinvestment period leveraged loan spreads widen, then as the CLO reinvests excess cashflows and early repayments the spread between the collateral pool yield and the CLO note funding costs widens, increasing the return to the CLO equity.

Obviously the CLO manager has to avoid defaults or stopping out of deteriorating credits at marked down prices to generate an overall benefit.

This credit spread widening benefitting CLO equity is exactly what happened in the 2 year period into March 2016, and in my view this cycle could potentially happen several times over the next 10 years or so.

Monday 26 February 2018

Wednesday 21 February 2018

Egypt enters a rate cutting cycle

So similar to my comments on Turkey, Egypt has had many problems over the last few years, compounded by the fall in the oil price and fall in tourism, two major hard currency earners.

An IMF loan and high interest rates attracting flows seem to have stabilised things. Inflation has peaked and the central bank cut interest rates 100bps this month. The new inflation target is 10-16%, vs 5% GDP growth.

Revenues and volume numbers from both tourism and oil production look like they are picking up.

The balance of trade is picking up off the lows. But what the country needs is a sustained period of cheap currency and domestic investment in manufacturing and job creation.

The country exported less than $1bn in 2016 to China and Germany combined while importing $7.6bn and $5.1bn respectively. Very similar trade balance problem to Turkey. Yet again China and Germany have exported their saving surplusses and undermined the domestic manufacturing base of a country.

The yield curve is also reflecting expectations of compression.

With 5% GDP growth and a double digit inflation target, buying long duration bonds now is really a bet on inflation falling to below target levels.

The stock maket as per the ETF on the other hand has a 25% RoE despite all of these problems and is on a forwards P/E of only 10x.

Looking at the CPI history it has been low before but generally ranged between about 5% and 12%.

If set against a 5% GDP growth inflation falls to high single digits then both the stock and bond markets may perform well.

An IMF loan and high interest rates attracting flows seem to have stabilised things. Inflation has peaked and the central bank cut interest rates 100bps this month. The new inflation target is 10-16%, vs 5% GDP growth.

Revenues and volume numbers from both tourism and oil production look like they are picking up.

The balance of trade is picking up off the lows. But what the country needs is a sustained period of cheap currency and domestic investment in manufacturing and job creation.

The country exported less than $1bn in 2016 to China and Germany combined while importing $7.6bn and $5.1bn respectively. Very similar trade balance problem to Turkey. Yet again China and Germany have exported their saving surplusses and undermined the domestic manufacturing base of a country.

The yield curve is also reflecting expectations of compression.

With 5% GDP growth and a double digit inflation target, buying long duration bonds now is really a bet on inflation falling to below target levels.

The stock maket as per the ETF on the other hand has a 25% RoE despite all of these problems and is on a forwards P/E of only 10x.

Looking at the CPI history it has been low before but generally ranged between about 5% and 12%.

If set against a 5% GDP growth inflation falls to high single digits then both the stock and bond markets may perform well.

Tuesday 20 February 2018

The Federal deficit and the 'LBO Whitehouse'

The US Federal govt burnt through $666bn in cash and $1.16Tn in actuarial type deficits last year, 8 years into the cycle. 666 coincidentally being the number the S&P bottomed at in 2009.

Primary dealers are forecasting roughly $1Tn cash deficits in the next two years on tax reform. Much worse than the old forecasts in the chart below.

100bps rise in Treasury financing costs is worth $150bn a year.

You have to wonder how bad the long term cyclically adjusted deficit is, $1.5Tn?

The government shows $3.5Tn of assets and $24Tn of liabilities, so this cash flow based lending par excellence.

So in the 'LBO Whitehouse', the focus will be growing the top line (nominal GDP) while capping interest costs at a relatively low level and compounding up the spread. Pretty much what China is also doing.

Primary dealers are forecasting roughly $1Tn cash deficits in the next two years on tax reform. Much worse than the old forecasts in the chart below.

100bps rise in Treasury financing costs is worth $150bn a year.

You have to wonder how bad the long term cyclically adjusted deficit is, $1.5Tn?

The government shows $3.5Tn of assets and $24Tn of liabilities, so this cash flow based lending par excellence.

So in the 'LBO Whitehouse', the focus will be growing the top line (nominal GDP) while capping interest costs at a relatively low level and compounding up the spread. Pretty much what China is also doing.

Turkey in line for a 'peace dividend'

Turkey has been caught between slow growth in Europe, the EM downturn through to 2016, conflicts in Iraq and Syria and with its own Kurds, Erdogan's nationalism and recently with inflation from imported commodities.

The stock market has lagged the EM recovery and the iShares ETF/ local market in USD is basically flat since inception. It's on 10-11x P/E and 1.6x P/B. Within that a few growth/ compounder names are on 20 something P/Es and the banks are on single digits. Halkbank is priced at a discount, but others are priced a little over book value. Halkbank's situation is complicated by a trial in the US related to Iran sanctions breaches but it is still growing domestic lending in 2018.

With ISIS gone, hopefully the security situation can settle down and Turkey may enjoy a 'peace dividend'. The FX is cheap and offers a decent carry pick up over Euros, while inflation is likely to start to fall if the currency stabilises and the central bank would probably try and get rates down to 6% or so from the current 8%, the expectation of which should attract fixed income portfolio flows. Receiving rates should be a fairy high Sharpe ratio trade. The FX is normally OK until after the summer where the tourism revenues drop off and that had in recent years been the catalyst for a devaluation. With the Euro having been strong against the USD and the Ruble also recovering, a flat USDTRY rate represents a further devaluation.

If equity investor perceptions change and they perceive Turkey as a large, relatively high growth country with a cheap currency on the outskirts of Europe then the market as a whole and the banks should reprice higher.

Turkish companies should also benefit from any rebuilding in Syria and there are many in the constriction/ aggregates sector that will be well positioned despite the complicated political situation in the border region. Perhap's Turkey's border incursions are more about positioning the ethnic Turk Syrians for the coming government negotiations and ensuring Turkish companies are benefitted from the economic recovery and spending than anything broader, whilst also trying to prevent emboldened Kurds from trying to change the siutation within Turkey.

https://ycharts.com/companies/TUR

Chart Sources: variously FRED, ycharts.com, MSCI.

Monday 19 February 2018

What is my 'Fourth Turning' investment outlook?

One of my peers remarked that he was surprised I am bullish on what he sees as high beta assets like EM, while being so negative/ sceptical on core markets. So I thought I would sketch out my views.

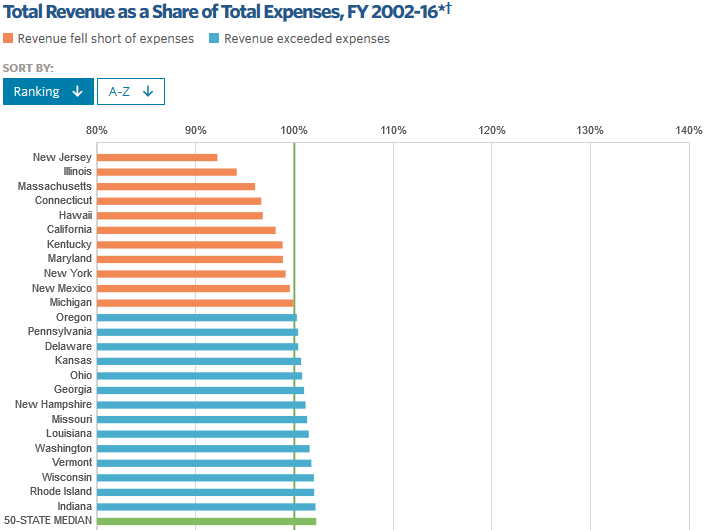

Source: PewTrusts

Source: PewTrusts

My views are roughly as follows:

- Post-08 cycle led by US and China and credit spending/ rate cutting is basically finished, not quite finished but heading towards the end.

- If the Fed went to neutral interest rates, say 5%, we would have a recession

- However, Fed is loose and likely to stay loose (the Real Estate/ LBO Fed/ Whitehouse).

- We also have MAGA as a theme in the political economy and more generally the Fourth Turning drivers, or Global Trumpism as Mark Blythe calls it.

- So my idea is that with continuing low rates we enter a new economic cycle without a recession, we are seeing early signs of this last year with wages growing faster than GDP and manufacturing rebounding.

- In otherwords we have some sectors in recession, e.g. oil/ mining/ manufacturing, 2014-16, other growing and overall GDP slow positive growth. Next recession sectors: retail, retail real estate, consumer credit dependent businesses, companies dependent on cheap labour and cheap debt so quick service restaurants, weak companies with low margins (ie corporate zombies) etc

- Fed hikes a bit, to say 3%, defaults grind higher, overall GDP growth is a bit slow, wages grow as a % of GDP, corp profits decline as a % of GDP, govt tax base improves as wages rise, savings rate goes up, domestic manufacturing does well, CA deficit shrinks. oil production continues to rise. Basically it's Michael Hartnett’s Main Street > Wall Street theme.

- So new cycle drivers: wages rising as a % of GDP and then spent, oil production up, manufacturing and investment up. New industrial revolution: robotics, other new manufacturing processes such as combining image recognition with manufacturing, self-driving vehicles, automated warehouses, EV cars go mass market, other areas of nanotech going commercial, clean energy prices continuing to fall, energy storage being adopted, more medical technology breakthroughs leading to longer life expectancies and keeping baby boomers ‘alive but unwell’ for longer.

- Real assets with pricing power do well benefitting from the increase in revenues linked to GDP or these growth driver sectors.

- Companies lacking pricing power, too dependent on low wages, global supply chain, cheap credit, zombie companies etc do badly/ disappear. This killing off of the zombies will be positive for productivity and wages in aggregate.

- A good example is fast food. McDonald's can automate almost all of its food production. Whereas a salad bar, sandwich shop, or say an Italian food restaurant will really struggle to replace people with machines anytime soon.

- I think baby boomers spending as much money as they need to stay alive is also an interesting theme in medical technology, so they will be live but unwell and needing multiple treatments in their retirement

- I also think EM entered a new cycle in March 2016. EM real estate in some markets seems cheap to me, credit spreads and equity earning yields are low. Private credit is attractive. There is probably scope for interest rate cuts in some of the stressed markets such as Egypt and Turkey.

- Oil entered a bull market in March 2016 that will ($100 target +/-$10) peak as EV cars break through to mainstream

- EV cars just need a cheap battery technology breakthrough such as graphene supercapacitors. It seems this technology is almost ready to go into production.

- I think Greece is recovering

- Balkan EU accession process is interesting

- Puerto Rico post restructuring will be interesting

- Vene has a chance to change but probably won't and I cant see a catalyst for the bonds unless they somehow start paying them again.

- I think pension liability driven financial crisis will hurt Connecticut, Kentucky, Illinois and other states

- There are some interesting credit dispersion trades in US municipal bonds. Buying Puerto Rico post restructuring is one such trade

So what could block this and cause a 2018/2019 recession? A rapid rise in the savings rate, rapid liquidation of inventories as a response to margin squeeze, rapid Fed hiking.

I think is Fed keeps rates low and hikes slowly to a terminal rate that is loose for the real economy interest rate (say 3% Fed funds vs 5.5-6.5% nominal GDP growth), that is stimulative for the real economy but negative for the financial economy, but not negative enough to cause a financial crisis.

I think its more like the 1970s where financial assets go sideways for years while inflation and wages go up

However we are not quite there yet, financial assets are still doing OK, wages are a bit slow, and the Fed is still loose

Some people think Puerto Rico could become like a Singapore. Most US states will have to increase taxes to cover pension and healthcare costs for baby boomers who started retiring in the last 2 years. The weakest states are already nearly bankrupt. But if you relocate to Puerto Rico then you pay something like 4% corporation tax and no state income tax.

What if for most pensions the following assumptions are wrong:

- Returns go to near zero for a decade instead of making 7%

- Baby boomers spending on healthcare and medical breakthroughs keep people alive for an extra few years, but at great cost

- Nominal GDP starts rising 6 or 7% a year (currently 5.5%)

- Min wages rise, a lot of government jobs are basic paying, a lot of healthcare jobs are too.

- If they increase their required yield to 8 or 9% as a result of all of this, then all the numbers for unfunded pension liabilities are going in the wrong direction.

We just had a 35 year asset market super cycle and the pensions are still underfunded....

US states can not default on debt. Some can restructure contractual liabilities such as pensions, eitherway taxes are likely to go up at the state level in many states.

Cities and municipalities can default. So you can get a pension fund 'run on the bank' where people start to cash out their pensions before the city or municipality defaults

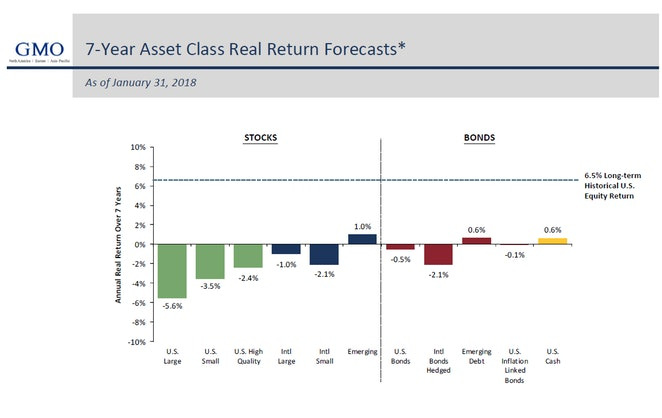

GMO forecasting negative returns for balanced portfolios.

Source: GMO

Subscribe to:

Posts (Atom)