As of February Bank Commercial and Industrial loans had fallen to +1.2% YoY. Whenever they have gone negative YoY, late cycle, there has been a recession, often they have lagged the start of the recession by the time they go negative.

Last week Commercial and Industrial loans grew $176bn, or 7.4%. That was companies drawing credit facilities in the face of a cash crunch.

I had had the view that the slowdown in Q1 would either lead to a market sell off/ recession scare or an actual shallow recession followed by a recovery in H2.

The combination of Corona disruption and the oil patch bust is going to drive a typical recession where corporate margin pressure leads to inventory liquidation, then credit crunch and job losses. Corona and oil were the final catalysts to turn a slow down into a recession.

But this takes a few months to play out, so while markets are rallying for now on hope and huge liquidity injection and can probably do OK into May or even June, a recession is likely to hit in Q3.

We will see new equity/ HY lows later in the year. Question is what bubbles have been built up in this cycle that are now destined to burst?

Monday 30 March 2020

Tuesday 24 March 2020

Trump juicing markets into the election

Trump just needs to elevate assets until the November election, after that he does not need to care

While the Fed can pin IG credit, HY and equities need some cyclical support so investors buy into the 'recovery story'

So the fiscal package is a political/ election issue but should get passed

He also needs to stop the oil price war to avoid or ameliorate an oil capex brick wall in Q3 sending the mid-west into a recession

As I have said before; now up, now down, like a bucket in a well.

While the Fed can pin IG credit, HY and equities need some cyclical support so investors buy into the 'recovery story'

So the fiscal package is a political/ election issue but should get passed

He also needs to stop the oil price war to avoid or ameliorate an oil capex brick wall in Q3 sending the mid-west into a recession

As I have said before; now up, now down, like a bucket in a well.

Monday 23 March 2020

Is Corona just a trivial seasonal flu that caught the medics off guard?

This is an interesting article on Corona.

https://www.nationalreview.com/2020/03/coronavirus-pandemic-doctors-take-serious-disease-shutdown-approach-may-be-imperfect/amp/

The true fatality rate is likely to be a fraction of 1%.

If you exclude those who are in the process of dying anyway (which are excluded from flu stats) and those dying from CRS who are now being treated with auto-immune suppressing drugs like chloroquine and once they have delivered some more respirators to treat pneumonia...

I think after that you are left with a true mortality rate that is a fraction of 1% & is mainly confined to the over 65s. So similar to seasonal flu.

Corona has not really spread in areas >10 degrees C, and even the UK now is going above that temperature as we enter Spring.

As they curtail case growth and are confident they wont be overwhelmed with pneumonia cases vs bed/ ventilator capacity, then the movement restrictions should be lifted and the market will forget about Corona quickly.

I was accused last week of 'downplaying' Corona by two people, but I am just looking at & trying to understand the numbers, the response & outcome. If my conclusion was millions would die, I would say so, but to me it looks like a new strain of virus caught the medics off guard, it spread fast in cool weather but now they have the measure of it & are successfully treating it.

https://www.nationalreview.com/2020/03/coronavirus-pandemic-doctors-take-serious-disease-shutdown-approach-may-be-imperfect/amp/

The true fatality rate is likely to be a fraction of 1%.

If you exclude those who are in the process of dying anyway (which are excluded from flu stats) and those dying from CRS who are now being treated with auto-immune suppressing drugs like chloroquine and once they have delivered some more respirators to treat pneumonia...

I think after that you are left with a true mortality rate that is a fraction of 1% & is mainly confined to the over 65s. So similar to seasonal flu.

Corona has not really spread in areas >10 degrees C, and even the UK now is going above that temperature as we enter Spring.

As they curtail case growth and are confident they wont be overwhelmed with pneumonia cases vs bed/ ventilator capacity, then the movement restrictions should be lifted and the market will forget about Corona quickly.

I was accused last week of 'downplaying' Corona by two people, but I am just looking at & trying to understand the numbers, the response & outcome. If my conclusion was millions would die, I would say so, but to me it looks like a new strain of virus caught the medics off guard, it spread fast in cool weather but now they have the measure of it & are successfully treating it.

The Fed is buying everything, so you should too!

Below is the lastest FOMC decision. Thats basically everything, and it was a completely predictable policy response, so buy the dip

Get ahead of the Fed as they are guaranteed to buy after you

Trust

that medics with 30+ years experience know how to treat pneumonia, but

got caught off guard for a month or two by a new virus and no predefined

treatment strategy

Corona is soon to be a distant memory but the usual suspects are still in a tail spin over it

If

when credit markets lose 4-5 years of return over a health scare, if

you cant pull the trigger, the next ten years of mostly rangebound

markets are going to be difficult for you

Thursday 19 March 2020

Monday 16 March 2020

Beware the Ides of March!

According to wiki:

That led to a civil war.

As for the longer term market and economic implications, if no one can go bust, and there is no meaningful recession, and we have combined low rates and fiscal stimulus, then we should remain at full employment.

If that happens then over time wage inflation should creep up, corporate margins normalise and corporates will be forced to invest in productivity/ capex to survive. Ie we have an economic cycle underpinned by wage inflation/ investment and productivity growth, and not a cycle led by credit and asset markets.

https://www.jpmorgan.com/jpmpdf/1320748251986.pdf

"The Ides of March is the 74th day in the Roman calendar that corresponds to 15 March. It was marked by several religious observances and was notable for the Romans as a deadline for settling debts.

In 44 BC, it became notorious as the date of the assassination of Julius Caesar which made the Ides of March a turning point in Roman history."

That led to a civil war.

"The

final defeat of Mark Antony and his ally Cleopatra at the Battle of

Actium in 31 BC, and the Senate's grant of extraordinary powers to

Octavian as Augustus in 27 BC – which effectively made him the first

Roman emperor – thus ended the Republic."

So the Ides of March were the turning point for Rome to move from a Republic to a form of dictatorship.

So did we see a policy framework turning point yesterday? Perhaps, yes, that no one is allowed to go bust and the Fed will do whatever it takes to avoid a meaningful recession and do whatever it takes to get ahead of markets.

As Bob Janjuah previously observed, the reaction function now is to avoid a bad recession/ financial crisis at all costs, as the main Central Banks know they will be blamed and will lose their independence.

As Bob Janjuah previously observed, the reaction function now is to avoid a bad recession/ financial crisis at all costs, as the main Central Banks know they will be blamed and will lose their independence.

But so far markets not initially reacting well to emergency FOMC. Which makes me think most active traders are positioned for things to get worse. So therefore the alpha is for the market to take a more constructive view on the outlook. Particularly now that banks like Goldman have spent a week selling 'bear trades' to their clients at multi-standard deviation volatilities.

The fact is we are at 0% rates (250bps 9m change) at full employment with QE restarted and a >$1Tn fiscal deficit. Just need the USD to fall against the majors now.

As for Corona, the economic disruption is as real as people want it to be, but the actual healthcare impact is trivial.

Powell knows what the NY Fed will be doing this week:

'...go in strong and buy across the curve'

As for the longer term market and economic implications, if no one can go bust, and there is no meaningful recession, and we have combined low rates and fiscal stimulus, then we should remain at full employment.

If that happens then over time wage inflation should creep up, corporate margins normalise and corporates will be forced to invest in productivity/ capex to survive. Ie we have an economic cycle underpinned by wage inflation/ investment and productivity growth, and not a cycle led by credit and asset markets.

Some comments on Corona

Corona has spread in dry, moderately cold places.

In cold and wet or really cold places it has not spread. Why? Because in the latter people are indoors in 20 degrees plus heat and it doesnt spread in 20 degrees heat, just as it has not really spread in hot places like Singapore, Taiwan, Thailand.

Its only really spread in places at 5-10 degrees and where there are people outside, interacting a lot and the virus can survive 5-10 minutes in the air, long enough to be transmitted.

So as we move into Spring in most of the cold places, the weather window for large scale transmission is closing out rapidly.

There will still be small numbers getting it, and for sure its a worse illness than common flu, but at a systemic level, it will have blown over.

Michael Cembalest's report from earlier this week shows how trivial the numbers are in China outside of Hubei where the virus got a chance to break out before a response happened.

Friday 13 March 2020

ECB and Fed unleash a $5Tn bank subsidy/ monetary carpet bombing

We are not so much witnessing a monetary bazooka being fired, as a coordinated carpet bombing

The Fed is offering >$1.5Tn to repo to Primary Dealers to buy Treasuries and clip coupons when they cut rates and resteepen the curve next week.

The ECB announced a TLRTo worth EUR2.3Tn. At -0.75%. BTPs yield 1.8%... and can be bought with no capital charge by say Deutsche Bank.

That would put them on 4x P/E just from this TLTRO. Surely even Deutsche cant screw this up...

There was also EUR800bn of capital relief per the twitter note below.

https://mobile.twitter.com/jeuasommenulle/status/1238134375499337728

The Chinese cut the Reserve Ratio and that was worth $80bn or so.

https://mobile.twitter.com/C_Barraud/status/1238394446716309505

The BoJ and BoE also took actions.

So in summary, between the ECB and Fed alone we just saw far in excess of $5Tn thrown at the markets...

Question is what to buy.

The Fed is offering >$1.5Tn to repo to Primary Dealers to buy Treasuries and clip coupons when they cut rates and resteepen the curve next week.

The ECB announced a TLRTo worth EUR2.3Tn. At -0.75%. BTPs yield 1.8%... and can be bought with no capital charge by say Deutsche Bank.

So spell this out for those who are a not focussing.

If

Deutsche Bank's market cap is €11bn and they can borrow from the ECB at

-75bps and buy BTPs at 1.8% with no risk and no capital charge, how

much of the ECBs €2.3Tn TLTRO announced yesterday do they need to use to

make €2.5bn net profits and be on 4-5x P/E, based on this one TLTRO

alone?

With some operating costs and taxes Im guessing about €130-140bn?

That would put them on 4x P/E just from this TLTRO. Surely even Deutsche cant screw this up...

There was also EUR800bn of capital relief per the twitter note below.

https://mobile.twitter.com/jeuasommenulle/status/1238134375499337728

The Chinese cut the Reserve Ratio and that was worth $80bn or so.

https://mobile.twitter.com/C_Barraud/status/1238394446716309505

The BoJ and BoE also took actions.

So in summary, between the ECB and Fed alone we just saw far in excess of $5Tn thrown at the markets...

Question is what to buy.

Thursday 12 March 2020

The cavalry have shown up

https://www.newyorkfed.org/markets/opolicy/operating_policy_200312a

Well assuming they cut rates next week, buy the dip.

>$1.5Tn in repo to the primary dealers if the curve steepens is pretty much free money to them.

Jap and EU banks only bought $4Tn or so from the Treasury in the last 11 years and the Fed has just thrown over half of that at the Primary Dealers to buy those Treasuries and hold them with positive carry.

VIX is at 64, lets see where it is in a month, about 15%?

Remember 2007, the banks nearly went under in December and the Fed threw liqudiity at them, and some markets made all time highs in June 2008.

But I think the rally can be narrow and core assets only.

Trump wont be allowed a stimulus before the election.

And it will take a few months for the oil capex brick wall to ripple out.

Q3 will be cruicial to see if we are heading into a recession or not.

My guess is yes, but this Fed liqudiity pump will buy time for risk assets.

Short term we also need Corona virus scare to blow over as the temperatures warm up.

There is not much upside resistance until about 3000-3050...

Well assuming they cut rates next week, buy the dip.

>$1.5Tn in repo to the primary dealers if the curve steepens is pretty much free money to them.

Jap and EU banks only bought $4Tn or so from the Treasury in the last 11 years and the Fed has just thrown over half of that at the Primary Dealers to buy those Treasuries and hold them with positive carry.

VIX is at 64, lets see where it is in a month, about 15%?

Remember 2007, the banks nearly went under in December and the Fed threw liqudiity at them, and some markets made all time highs in June 2008.

But I think the rally can be narrow and core assets only.

Trump wont be allowed a stimulus before the election.

And it will take a few months for the oil capex brick wall to ripple out.

Q3 will be cruicial to see if we are heading into a recession or not.

My guess is yes, but this Fed liqudiity pump will buy time for risk assets.

Short term we also need Corona virus scare to blow over as the temperatures warm up.

There is not much upside resistance until about 3000-3050...

Tuesday 10 March 2020

Can the oil price war and the Corona outbreak tip the US into a recession before the election?

After more sell off this week I expect the FOMC cutting rates and restarting QE on the 18th will cause a rally in markets and a steepening of the yield curve during Q2. But I think the rally will be more like a short squeeze; so index led, some areas of better credit coming in, USD bounce. Overall I think an FOMC inspired rally will last 3-6 months max.

Auto sector malaise

After that the lack of auto recovery will be an issue again. As an anecdote I was at the auto shop today and the guy there was saying ordinary people simply cant afford EV's and PHEV's and the middle class don't want to sell older ICE cars partly due to cost, partly they are waiting to be forced/ incentivised to upgrade, so you have people holding onto 5-10 year old cars longer than they would otherwise. Also EV/ PHEV cars are not reliable enough; broken motors and batteries cost thousands to replace. So overall I think the auto recession will drag on and only a massive cash for clunker deal after a recession will turn it.

LMC Automotive data, global sales down 10% YoY to January:

US car sales are off a small amount over the last few years:

US China Trade War & EM trade

Then the trade war is unresolved, period. The drop in the oil price will slow EM growth and in turn US exports. Phase 2 of the China deal, which covers the most critical parts from China's standpoint, is hard to see happening this side of the election.

The fall in goods and services exports in 2000 and 2008 recessions both cost about 1.5% of GDP.

Oil Market Share War

There has been a lot of capex in the oil sector that has seen US production grow so much that net imports have gone from 12.5MMbpd to now a small net export position. The prospect of growing US exports has now triggered a price war by OPEC+ to protect market share.

The logic for OPEC+ is their balance sheets are stronger than leveraged US and other private sector oil producers. So by crashing the oil price now, they will try and bankrupt some of the higher cost offshore and tar sands producers and some of the leveraged onshore producers.

But OPEC+ need to make it painful enough for a few whales to go bankrupt and teach Wall Street to not finance higher cost producers going forwards. Given many E&P's hedge upwards of 50% of the next 12-months production, I'm not sure this war will be over by Christmas.

But OPEC+ need to make it painful enough for a few whales to go bankrupt and teach Wall Street to not finance higher cost producers going forwards. Given many E&P's hedge upwards of 50% of the next 12-months production, I'm not sure this war will be over by Christmas.

From a US economic stand point, oil related capex and the supply chain behind it have been a large part of US capex this cycle, the 2015/16 slowdown saw 'mining' sector capex halve and put several US states into recession/ near recession while the manufacturing sector as a whole went into recession.

Quarter on quarter a slowdown in mining/ energy can detract up to 1.1% from GDP, and then more in the manufacturing supply chain and service sector second round effects in the most affected states.

In the last oil price war manufacturing went from growing 4% a year to shrinking 1.8% by Q1-2016, quite an abrupt rate of change.

In 2015/16 oil slowed Texas down from 6% plus growth to zero and Texas has been one of the stronger growing states in the last couple of years.

Texas at about $1.9Tn GDP in 2019 would as a stand alone economy be of similar size to Russia and is 8.8% of US GDP.

Inventory Liquidations

What better way to manage cash flow, when you get squeezed? While the auto sector seems to have reduced inventory over the last few years, sectors like wholesalers have only just started and business inventories as a whole have been high.

One sector that has seen a large fall in

inventories to sales is retail and we know how many bankruptcies there

have been there. Below is what has happened to retail jobs:

So this time around we have the oil sector, exports and autos also going into a recession/ L-shaped recovery and the potential impact of inventory liquidations.

Corona virus distruptions

I do think the Corona virus will blow over during April as temperatures heat up - outbreaks have been limited to cold areas and only really broke out in Hubei because of an initial cover up. Apparently the high death rates in Italy is due to a shortage of respirators for those patients who suffer pneumonia, combined with a lack of initial outbreak containment.

However for the next few weeks it does look like the breakouts in Europe and the northern US states will get worse and disrupt the March and April GDP numbers and in my view are likely to drive more market sell offs before the FOMC on the 18th.

Credit default cycle

The defaults in oil are going to hurt credit. Most investors in credit are index investors, so to avoid the 9% in high yield that is energy related plus all of the other cyclical sector exposures, they generally have to sell their HY allocation as a whole. This dynamic blew out spreads across all of credit in 2016.

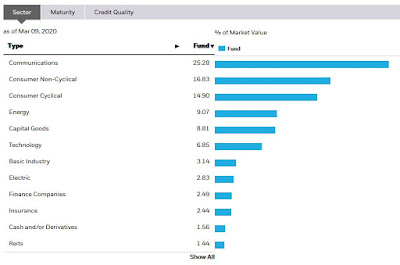

HYG ETF sectors:

HYG has a 6.00% OAS. The credit spread blow out so far has been very rapid, with 'B' OAS reaching 7.2% yesterday vs. about 7.7% in February 2016.

Conclusion

Adding all of this up, as many commentators have pointed out, the US private sector has been slowing towards a recession for months. The ISM Manufacturing survey was already showing falls in inventories, new orders, backlogs etc

So while I think the FOMC can juice markets for a few months, the underlying problems should hit in the run into the election campaign and the Democrats won't want a big fiscal stimulus to try and help Trump win re-election, in fact they would probably prefer a small market crisis. Democratic control of Congress can prevent any major stimulus happening before the election, although I am sure some health care spending will be agreed.

So that's it, my base case is more sell off over the next seven days, then FOMC stick save and a narrow short squeeze driven rally for a few months. The assets that don't participate in the rally go into a consolidation pattern for 3-6 months, similar to what happened in the chart below between March and August 2008.

After that, as the economy and corporate profits surprise on the downside again, then a renewed sell off/ recession/ liquidation event later this year will clear the way for fiscal deficits for as long as it takes to get higher wage inflation going.

Monday 9 March 2020

Could the FOMC be a turning point next week and whats the outlook for bonds?

The FOMC is next Wednesday and I expect they will cut 50-75bps and restart QE. That should put an interim floor under markets and set up a bounce for a few months at least towards the election.

So while liquid markets will probably sell off more this week and into early next week, for less liquid markets like credit, when you look back in a few months time, the stress this week might turn out to have been the ideal buying entry point.

Turning to government bonds, UK Gilts have almost reached zero yields. With the UK government able (and now willing) to borrow for 10 years for less than 10bps, Boris Johnson could spend £100bn on infrastructure for about £100m a year in interest.

The UK and the US and even the EU are not Japan. Why would anyone choose to own a zero returning duration asset? Only as you think you can sell it at a higher price to someone else later. Thats the definition of a speculative bubble/ ponzi scheme.

With western politics pointing towards wage inflation/ MMT, these bonds will turn out to be absolutely terrible medium term investments.

Central Banks either cant spot or choose to ignore asset bubbles. Well this one

is right in front of them, in investment grade duration.

Friday 6 March 2020

Update on the 'Yen Plaza Accord'/ liquidation event trade

One of my core, end of cycle, meltdown views has been the Yen rallying massively, similar to the Plaza Accord, as QE leakage gets rapidly repatriated in a liquidation event. Currently the US curve inversion is driving that repatriation (if you are going to borrow $4Tn from foreign banks, you should probably make sure it is positive carry for them).

The Yen/ Won pair in the last two global meltdowns doubled and its starting to move again now.

I think that the pair is currently saying this is just the shaky beginnings of something much bigger, later. Ie it is the prelude of what might happen, say next year or later this year. The start of my chart's 100% move is September 2018, so just before the Q4 2018 meltdown, but also that shows it has taken 18 months since then to get to where we are now, with a more pronounced breakout/ liquidation event. Perhaps the current liquidation event should have been in October 2019 (had the Fed not re-started not-QE).

Looking at 2008, which was also a slow moving car crash, starting late 2006 with sub-prime/ adjustable rate mortgages; from March to August 2008 it went into a consolidation pattern until the real liquidation event happened.

Then when it really did start to move, it didn't stop.

So we are seeing the initial move now, and if the Fed cuts to 25-50bps this month, that might put markets into a pause until later this year, before a likely relapse, driven in my view by compressing corporate profits in the US.

JPY/ CNY is also an interesting long term chart, but the CNY is much more substantial a currency than Korea, an exporter of cyclical goods.

Are we approaching a market meltdown driven by the curve inversion?

I had previously said I think 10yr US Treasury yields could bottom in April at 75-85bps. Well six days later we are below that range... risk happens fast I guess.

I think the Fed needs to flatten or steepen the curve to stop Jap and EU banks selling to primary dealers and crushing liquidity. So if they actually understand what they are doing they should do an emergency 75bps. Until then we have liquidation, same as what was happening in October. But if they do cut, it could turn the tables quite quickly.

This chart shows the repatriation of capital back to Yen when the curve inverts. EU and Japanese banks have lent about $4Tn in this cycle via QE leakage to the US government, hence USD weakness and EUR and JPY strength on risk off/ curve inversion.

If

the Fed cuts to 30bps or so EFFR it will mean the curve is steep and we

start to see the capital come back out of Japan and EU. But will they

do 75bps in an emergency meeting next week? Or wait for the FOMC on the

18th or just do 50bps? Who knows.

The S&P on the other hand looks to me like it could punch below 2800 without hitting too much technical resistance if there is no emergency meeting.

However, later this month I think the 'Corona virus is going exponential' fears should subside.

And I do think there is a second half economic rebound.

So perhaps this slowdown and market clear out will be the pause that refreshes?

Thursday 5 March 2020

Does Copper offer an assymetric 'China bust' trade?

Copper seems to be being defended at about $2.53-2.55/ lb, I presume by Chinese buyers, who perhaps have loans against copper warehouse inventories.

Meanwhile Oil and Copper mining stocks are down 20-25% YTD

Is this the asymmetric China bust trade that Kyle Bass has been waiting for?

Lebanon update, hints of a debt reprofiling deal emerge

I wrote up a note on Lebanon previously when the bond strip was in the 40s and I expected them to fall further but for the actual debt restructuring to not be nearly as bad as the bond prices implied.

Yesterday Reuters reported a 5 year maturity extension, with coupons cut to zero for the extension period, as being tabled by Finance Minister Ghazi Wazni.

However he then denied that it has been 'formally proposed'. But my guess is its in an advanced discussion and Reuters checked the story before running it.

I think this could be a workable reprofiling. If they get donor aid for refugees/ to fund CA deficit and CEDARs money released for infrastructure to kick start the economic rebound.

They did have higher government debt to GDP in the past without defaulting, but for the government to delever you need other parts of the economy to grow/ run a sectoral deficit.

A final peace and recovery in Syria would also help.

It would appear they will pay the bond next week as well, causing the bond to rally.

The rest of the strip is still in the high 20s, example below.

In the prior note I had expected a 45-60% recvovery in a managed deal scenario with the bonds trading down to maybe 25c before a deal is announced. In a 'no deal hard default' outcome I had expected a 45c or maybe lower recovery and the bonds going below 20c for a period.

If a deal is going to be agreed based on the Reuters report, then discounting the bonds for 5 years as a zero coupon at a 9% interest rate gives a NPV of 65c. If those bonds in 5 years had say a 5 years to maturity remaining (2030 maturity) with a 6% coupon and an 8% required yield, at that point, they would be trading at 92c in 2025 and the NPV now drops to circa 60c.

So the bonds at 25-30c now are pretty inexpensive. As long as they can agree a deal and then implement the reforms and the economy rebounds. Which are quite a big ask by themselves.

Wednesday 4 March 2020

Is the Fed too loose for the real economy?

I think this chart shows the

level of divergence between the real economy and the credit bubble

fuelled financial economy quite well.

Normally

when 3-month wage growth for job switchers is this strong vs overall

wage growth, it means the labour market is tight enough for neutral Fed

rates (let's say 4%) for the real economy, then with enough corporate

margin compression there is a normal recession, labour pressure goes

down and the Fed cuts as the recession happens.

By

April I assume the Fed will be at 25-50bps, which shows how far away

the neutral financial system Fed funds rate is from the real economy neutral Fed funds rate.

The real economy has slowed, mainly due to the auto sector, tariff

impacts and some signs of inventory liquidation, but its not in a full

blown recession.

Add

on top of that a >$1tn fiscal deficit... and a wage/inflation/

investment led cycle and cyclical rebound is baked in for the second

half.

Tuesday 3 March 2020

The Fed and the LBO Whitehouse

The market wants another 50bps at least from the Fed

The Fed will have to cut to 50-75bps to put any shape in the curve and will likely have to cut to 25-50bps to resteepen the front end and save the Primary Dealers from having to buy Treasuries that foreign banks dump onto them.

Something I have described is the 'LBO Whitehouse's economic model In the LBO model you try and keep debt costs fixed and then lowered while growing revenues over several years to get an equity multiple

Trump has almost got borrowing rates down to negligible levels. While a $1tn plus fiscal deficit is supporting final demand in the economy as the impact of tariffs and the auto sector slowdown ripples through it

In the end whether we get a shallow recession or just a recession scare, I think the real economy in the US and globally rebounds in the second half. If we then see wage inflation pushing up to 4-4.5% against a Fed cowering at 50bps, Powell will then be under mandate pressure to start a hiking cycle even though the economy will be in a state of stagflation

Trump's business track record can be characterised as spending a huge amount upfront, revenues falling short and defaulting when the Fed hikes rates. His MO doesnt seem to have changed much.

I think it is during that stagflationary hiking cycle, that squeezes corporate margins back to normalised levels, that equities crash.

Whats happening now with Coronavirus scare is just a late cycle prelude to it and equities will most likely relief rally in April or May as the warm weather dries the virus out and the economy starts to rebound.

The Fed will have to cut to 50-75bps to put any shape in the curve and will likely have to cut to 25-50bps to resteepen the front end and save the Primary Dealers from having to buy Treasuries that foreign banks dump onto them.

Something I have described is the 'LBO Whitehouse's economic model In the LBO model you try and keep debt costs fixed and then lowered while growing revenues over several years to get an equity multiple

Trump has almost got borrowing rates down to negligible levels. While a $1tn plus fiscal deficit is supporting final demand in the economy as the impact of tariffs and the auto sector slowdown ripples through it

In the end whether we get a shallow recession or just a recession scare, I think the real economy in the US and globally rebounds in the second half. If we then see wage inflation pushing up to 4-4.5% against a Fed cowering at 50bps, Powell will then be under mandate pressure to start a hiking cycle even though the economy will be in a state of stagflation

Trump's business track record can be characterised as spending a huge amount upfront, revenues falling short and defaulting when the Fed hikes rates. His MO doesnt seem to have changed much.

I think it is during that stagflationary hiking cycle, that squeezes corporate margins back to normalised levels, that equities crash.

Whats happening now with Coronavirus scare is just a late cycle prelude to it and equities will most likely relief rally in April or May as the warm weather dries the virus out and the economy starts to rebound.

Monday 2 March 2020

Is a whale defending the Copper and Iron Ore prices?

Is there a whale defending the low $80s in Iron Ore and about $2.55 in Copper?

Subscribe to:

Posts (Atom)

3000 is a pretty good target for the S&P for now.

If it starts to move there, career risk reappears for long onlies missing out.

But there is no pull to par in equities.

To paraphrase Chaucer: 'Now up, now down, like bucket in a well.'